Forecasting industrial real estate supply and demand is an important task for many commercial real estate professionals. For example, developers interested in constructing a new industrial park need to consider whether there is sufficient demand to support the new development. Supply and demand conditions also affect market rents and vacancy rates, which in turn determine property valuation, and ultimately impact the owner’s rate of return. In this article we’ll walk through how to forecast industrial real estate supply and demand using the Orlando, FL metro area as a case study.

Population Trends and Industrial Real Estate Demand

Recent data from the U.S. Census Bureau and the Orlando Economic Development Commission lists the total population of the Orlando metro area at 2,387,138 (2016). Between 2015 and 2016, the population of the Orlando metro area grew by 2.6%. The Orlando metropolitan area is one of the fastest growing areas in the United States. The Orlando Economic Development Commission estimates that population growth in the region since 2000 equates to a gain of 138 people per day. Both tourism and emigration into the area drive high growth in population and economic activity. This growth spurs industrial demand for e-commerce and logistics networks. Orlando International Airport is the eighth busiest in the United States, and the area is also a transportation hub for major highway traffic throughout the state.

Economic Trends and Industrial Real Estate Demand

According to employment data gathered by the Bureau of Labor Statistics, economic growth in the Orlando metro area is certainly one of the main drivers of population growth trends. Job growth in Orlando between 2015 and 2016 was more than twice the national average. These trends in employment and population growth are expected to continue over the next few years unless impacted by unanticipated external events or natural disasters. Employment growth in the Orlando metro area actually exceeded the population growth rate, which indicates that even more new workers will need to move to the area in order to sustain this economic growth.

| Area | Industry | Annual Average Employment | Change Employment 2015-2016 | Growth Rate | |

| 2016 | U.S. TOTAL | Total, all industries | 141,870,066 | 2,378,367 | 1.71% |

| Orlando-Kissimmee-Sanford, FL MSA | Total, all industries | 1,157,536 | 46,844 | 4.22% | |

| 2015 | U.S. TOTAL | Total, all industries | 139,491,699 | ||

| Orlando-Kissimmee-Sanford, FL MSA | Total, all industries | 1,110,692 |

The Orlando metro area, however, is densely populated. Industrial businesses not only demand a location close to transportation hubs but also large tracts of land with relatively low rents. The high demand for real estate to meet the tourism, retail, residential, and office space pushes real estate prices higher. The appraisal concept of highest and best use states that land should be utilized in the way it can generate the highest value. Economic models of urban growth also support this observation. The concentric growth model proposes that bid-rent theory causes development of high-rise offices in the central business district. There is the highest demand for space in this area and therefore the highest rents. Only the most profitable real estate and business endeavors can afford to be located in this area. Factories or industrial zones and residential zones develop away from the central business district where rents are more affordable.

An analysis of industrial supply and demand conditions, however, must focus on the location and industries that make up the primary demand for industrial real estate. Industrial real estate holds manufacturing, warehouse, and transportation facilities. In 2016, there were over 20,000 businesses categorized as manufacturing or transportation, logistics, and utilities in Orlando and the surrounding market. Employment in those industries grew by 3% between 2015 and 2016 to a total of over 318,000 jobs. Other than Lake County and Brevard County, most of the Orlando industrial market experienced at least moderate growth between 2015 and 2016.

| Manufacturing | Establishments | Employees |

| Brevard County | 4.0% | 7.4% |

| Lake County | -0.9% | -5.4% |

| Orange County | 1.3% | 3.9% |

| Osceola County | 9.4% | 6.5% |

| Seminole County | 3.9% | 4.4% |

| Trade, Transport, Logistics | ||

| Brevard County | -1.0% | 1.0% |

| Lake County | 0.5% | 3.0% |

| Orange County | 2.1% | 3.6% |

| Osceola County | 1.4% | 5.2% |

| Seminole County | 0.9% | 1.6% |

Industrial Real Estate Supply and Demand

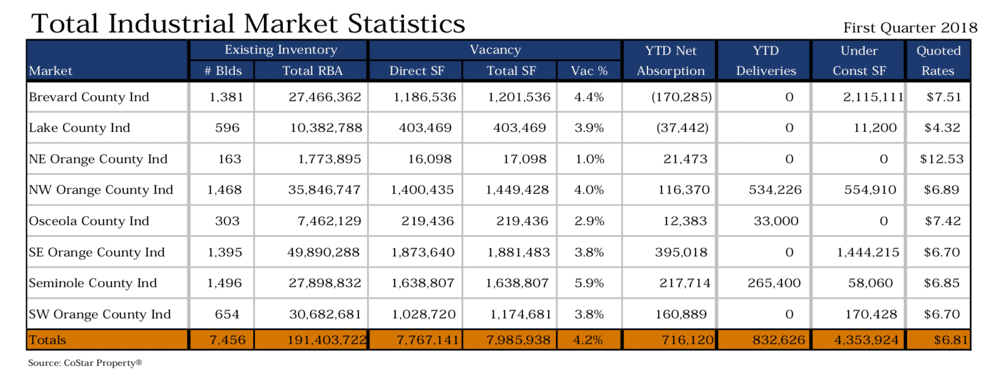

Data from CoStar Property reported a total of 7,456 industrial buildings and 191,402,722 square feet of industrial real estate within the Orlando industrial market area. The average vacancy rate was 4.2%.

A typical forecast of real estate demand examines the growth rate of the population or employment within certain industries. The goods producing, manufacturing, and trade, transportation, and logistics industries in the Orlando industrial market had a 3% growth in employment between 2015 and 2016. If employment growth is a proxy for industrial real estate demand, a growth rate of 3% annually would result in demand exceeding the existing supply of industrial real estate by 2020.

| 2018 | 2019 | 2020 | 2021 | 2022 | |

| Available | 191,403,722 | 191,403,722 | 191,403,722 | 191,403,722 | 191,403,722 |

| Vacant | 4.2% | 1.3% | -1.6% | -4.7% | -7.8% |

| Demand | 183,364,766 | 188,865,709 | 194,531,680 | 200,367,630 | 206,378,659 |

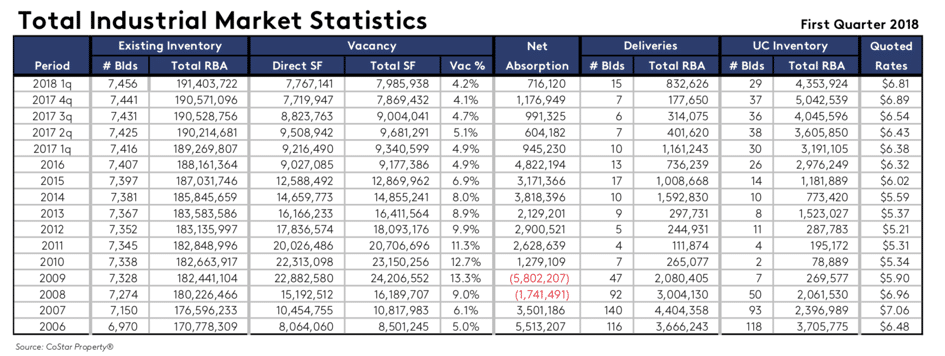

A developer analyzing the decision to develop vacant land in Orlando as a shopping center or warehouse space will choose the more profitable shopping center. Thus, most of the demand for industrial real estate will develop outside of the densely populated urban area. Looking to the area surrounding Orlando, supply and demand for industrial real estate are growing at a much higher rate. Data from CoStar Property shows that the Orlando industrial market has been absorbing 3,000,000 to 4,000,000 square feet of new industrial supply per year. At this rate, however, vacancy rates continue to rise.

Combining the average industrial employment growth rate and the current supply and demand for industrial space in the Orlando industrial market, it appears that an even greater stock of supply needs to be added to the market each year just to maintain the current occupancy rates. A steady 3% growth in demand would require a minimum of 5.5 million square feet of new space added to the market each year.

| 2018 | 2019 | 2020 | 2021 | 2022 | |

| Available | 191,403,722 | 196,903,722 | 202,403,722 | 207,903,722 | 213,403,722 |

| Vacant | 4.2% | 4.1% | 3.9% | 3.6% | 3.3% |

| Demand | 183,364,766 | 188,865,709 | 194,531,680 | 200,367,630 | 206,378,659 |

Real estate analysts, however, note that the demand for industrial real estate is changing. As a result, perceptions about the size and location of warehouses must be updated to include the new reality of technology and e-commerce. The shift from traditional retail shopping to e-commerce continues to change the landscape of commercial real estate. As online retailers expand same-day delivery options in urban areas, the need for smaller warehousing units within the city limits will also grow. Traditional urban growth models and industrial demand forecasts must consider these changes in shopping patterns and the resulting shift in industrial and retail real estate demand.

Conclusion

This example illustrates how to convert data about population growth, industrial employment, and real estate supply into a forecast of supply and demand conditions over the next five years. In the end, forecasting industrial property demand is more difficult than it may seem to be. The projections for growth of industrial real estate in the Orlando metro area greatly underestimate the demand outside the densely populated urban center of Orlando. The area defined as metropolitan Orlando has a high demand for real estate that supports the tourism industry along with the residential working population of the city. Demand for industrial real estate in Central Florida is strong and growing every year, but the supply will grow further outside the Orlando metro area where 1 million square feet industrial facilities can be built on large, open tracts of land at a much lower cost.