The sources and uses statement is important to understand in commercial real estate transactions. Yet, there is often a lot of confusion around what a sources and uses statement is and why it is needed. In this short article, we’ll take a look at the sources and uses statement, discuss how it is used in real estate finance and why it matters, and then we’ll walk through a couple of example sources and uses statements.

What is a Sources and Uses Statement?

First of all, what exactly is a sources and uses statement? A sources and uses statement simply shows where all the sources of funds for a project come from, and where all those funds are used in a project. This is important because it tells a story about how funds flow through a project.

One key requirement of a sources and uses statement is that the total sources of funds must match the total uses of funds. Why? Because all of the money has to go somewhere, and the sources and uses statement shows you where. If you have more uses of funds than sources of funds, then the project will need additional capital to work. On the other hand, if you have more sources of funds than uses of funds, then there will be excess cashflow available for distributions. Let’s take a look at an example sources and uses statement.

Sources and Uses Statement Example

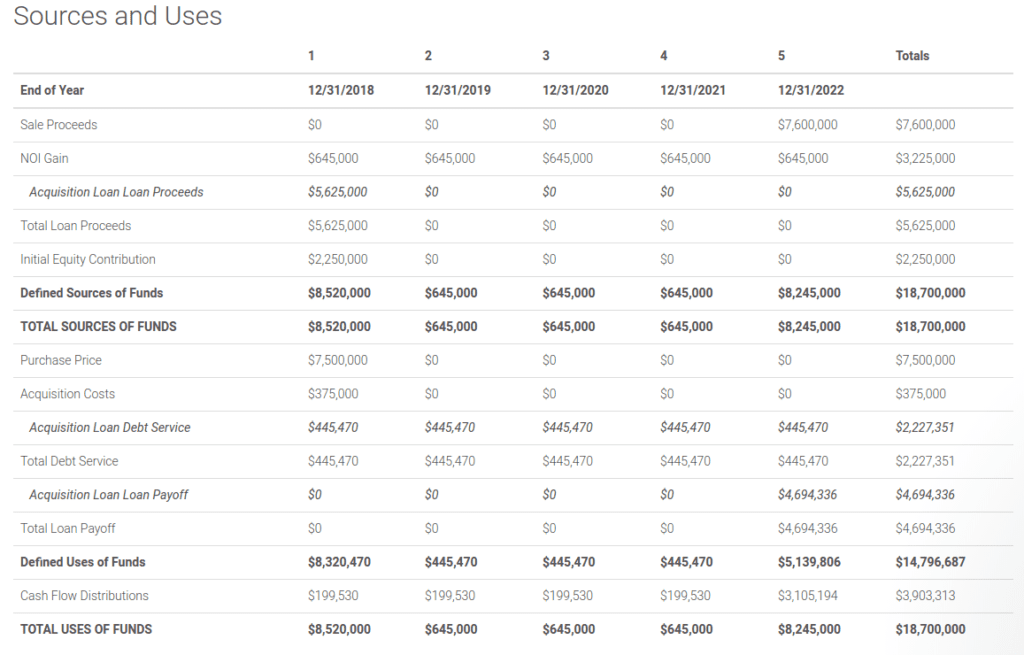

In the sources and uses statement above, the total sources of funds are listed out first and then the total uses of funds are listed out next. This is also done for each period in the analysis to show how the money flows over time. Let’s walk through each line item step by step for year 1.

The first line shows net sales proceeds as a source of funds. Since the building isn’t sold until the end of year 5 this is $0 in year 1. Next is the NOI Gain line item, which simply shows any positive Net Operating Income for that particular year. In year 1 this property generates $645,000 in positive net operating income, which means it’s now a source of funds for our project. Next is the Acquisition Loan Proceeds line item, which shows the $5,625,000 in loan proceeds received to acquire the property. Finally, we have an Initial Equity Contribution line item, which is the difference between the purchase price of the property and the loan proceeds above.

This gets us to the “Defined Sources of Funds” line item, which shows all of the sources of funds we’ve explicitly entered into our assumptions. If the total uses of funds did not match this figure, then there would be an additional line item here called “Additional Equity Required” which would be exactly the amount required to make the total sources of funds equal to the total uses of funds. We’ll see another example below where this applies, but let’s stick with this simple example for now.

Under the uses of funds section we first see the Purchase Price of $7,500,000 and then the additional Acquisition Costs of $375,000. Next we have our loan debt service of $445,470 and our loan payoff at the end of year 5 of $4,694,336. These are all of the uses of funds we’ve defined on the proforma and result in a total defined uses of funds of $8,320,470.

So, in year 1 we have total sources of funds of $8,520,000 and total uses of funds of $8,320,470, which leaves us with an extra $199,530. What do we do with these excess funds? Since they don’t have a defined use already, we assign them a use called “Cash Flow Distribution”. And as you can see above, we can complete this analysis for each year in the holding period to get a picture of where our sources and uses of funds come from and where they go, and also when these flows occur.

Another Sources and Uses Statement Example

Let’s take a look at another sources and uses statement that differs slightly from the one above:

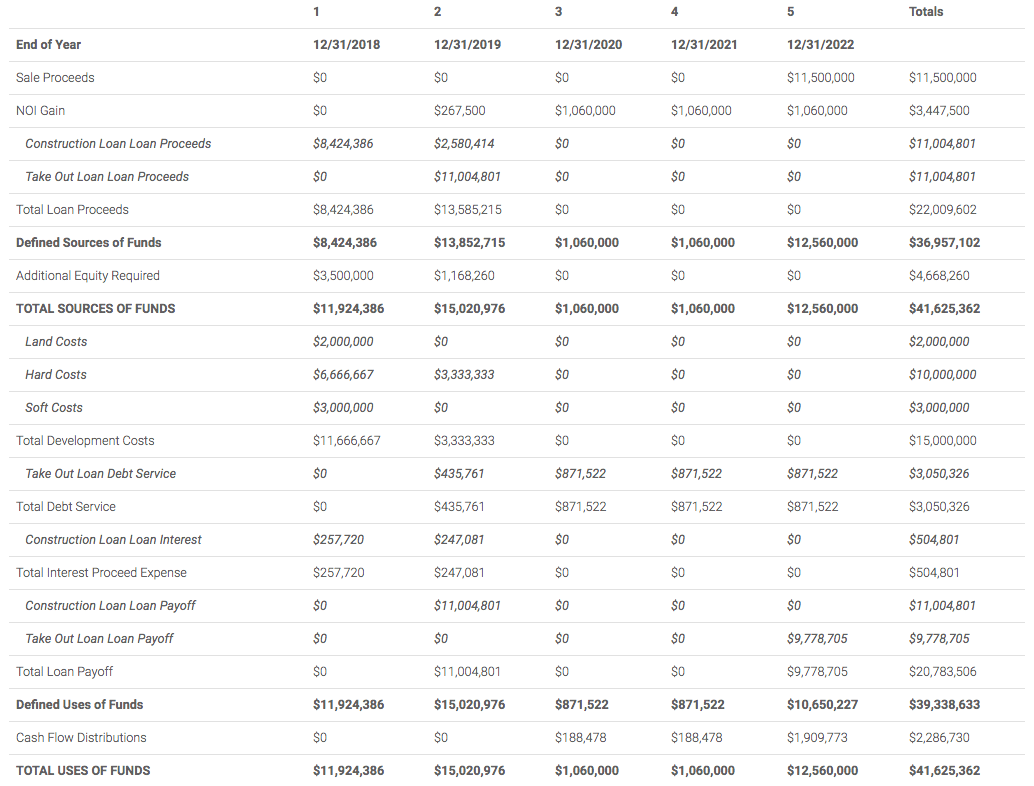

Let’s walk through each line item step by step again for year 1.

The first line shows net sales proceeds as a source of funds. Just like last time, since the building isn’t sold until the end of year 5 this is $0 in year 1. Next, in year 1 this property is being developed and therefore generates $0 in NOI Gain. Next is the Construction Loan Proceeds line item, which shows $8,424,386 in construction funding received in year 1. Then we have our Take Out Loan proceeds which is $0 in year 1. This means our total loan proceeds for year 1 consist solely of the construction loan draws.

This gets us to the “Defined Sources of Funds” line item, which shows all of the sources of funds we’ve explicitly entered into our assumptions. Since the total uses of funds does not match this figure (there is a $3,500,000 gap between the total defined uses of funds and the total defined sources of funds), there is an additional line item here called “Additional Equity Required.” This Additional Equity Required is exactly the amount required to make the total sources of funds equal to the total uses of funds. In this case it is $3,500,000. In other words, our project will cost us $11,924,386 in year 1, but we only have total loan proceeds of $8,424,386 and no other sources of funds defined. Therefore, we need an additional $3,500,000 in equity to make this project work.

Under the uses of funds section we first see the Land Costs, Hard Costs, and Soft Costs totaling $11,666,667. Next we have our Take Out Loan debt service of $0 because the take out loan doesn’t exist in year 1. Then we have our construction loan interest expense of $257,720. And then we see the Total Loan Payoff line item which, again, in year 1 is $0 because all loans mature after year 1.

These are all of the uses of funds we’ve defined on the proforma and result in a total defined uses of funds of $11,924,386.

The sources and uses statement above completes this analysis for each year in the holding period to get a picture of where our sources and uses of funds come from and where they go, and also when these flows occur.

Conclusion

In this post we talked about the sources and uses statement in commercial real estate. The sources and uses statement describes where all of the sources of funds for a project come from and where they go. It is used to provide a high level overview of funding for a project. We also walked through two different sources and uses examples for real estate projects that showed what the sources of uses statement looks like and how it works.