The operating expense ratio provides a lot of useful insight into a commercial property analysis, but it’s not as widely used as it ought to be. The operating expense ratio is a simple ratio that’s easy to calculate and in this article we’ll take a closer look at how to calculate the operating expense ratio, how to interpret it, and finally, we’ll tie it all together with a solid example.

Operating Expense Ratio Definition

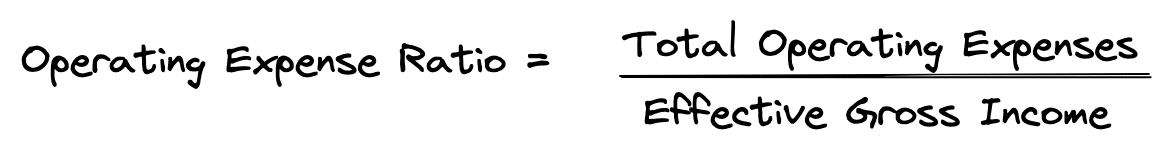

First, what exactly is the operating expense ratio? The operating expense ratio is simply the total of all expenses needed to operate a property divided by the Effective Gross Income for a property. Here’s the operating expense ratio formula:

The operating expense ratio formula measures how much of a property’s effective gross income is consumed by expenses needed to operate the property. When building a multi-year proforma, it can often be helpful to calculate an operating expense ratio for each year in the holding period to spot trends in total operating expenses, relative to potential rental income.

Operating Expense Ratio Example

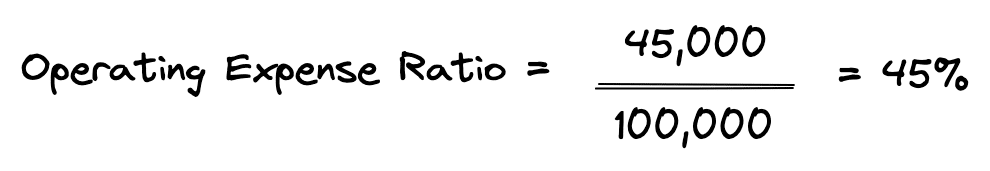

Let’s take an example to illustrate how to calculate the operating expense ratio. Suppose we have effective gross income of $100,000 and total operating expenses of $45,000. Here’s how we’d calculate an operating expense ratio for this property:

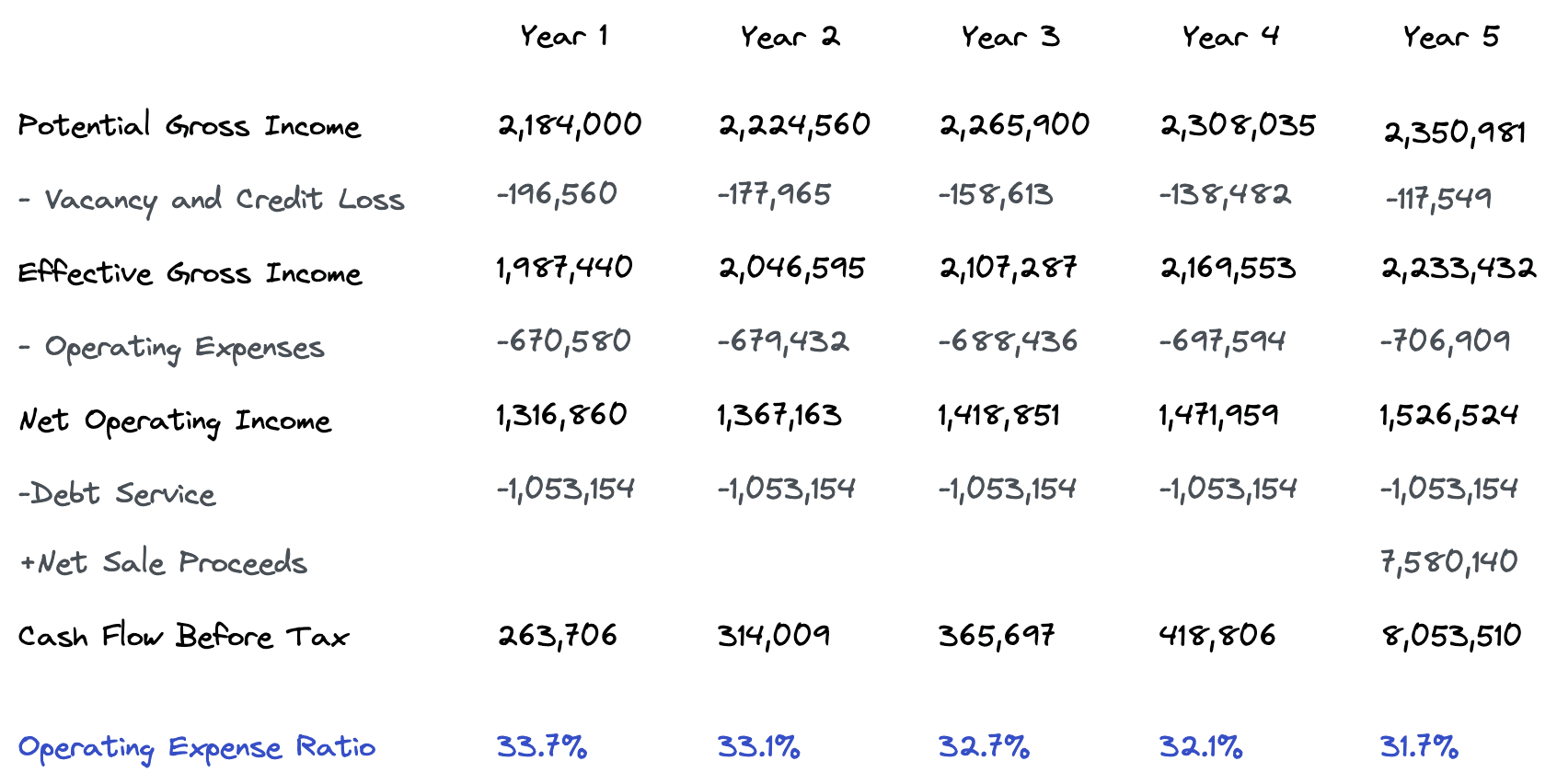

Now, let’s further suppose that we have a 5 year proforma that looks like this:

By calculating the operating expense ratio for each year in the holding period, we can quickly spot a trend in the total expenses as they relate to potential rental income.

As illustrated by the calculations above, the operating expenses for this property increase slower than our effective gross income does, which causes our operating expense ratio to decrease over the holding period. By calculating the operating expense ratio for each year in the holding period, we can quickly spot and quantify this trend at a glance.

Operating Expense Ratio Variations

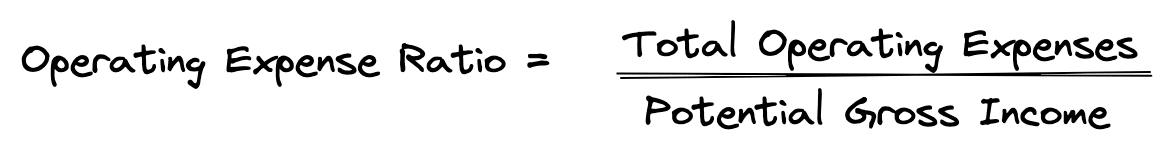

Sometimes you might see variations on how the operating expense ratio is calculated. For example, you might also see the operating expense ratio calculated using potential gross income instead of effective gross income. Effective gross income is just potential gross income less any vacancy and credit losses. In other words, potential gross income does not consider vacancy and credit loss. Here’s how this variation is calculated:

Depending on the purpose or the company you are working with, it is not uncommon to see variations on the operating expense ratio calculation. The important thing to remember is to make sure you understand the rationale and then remain consistent when calculating the operating expense ratio. This will ensure you are comparing apples to apples.

Conclusion

In this short article, we covered the operating expense ratio, which is a helpful calculation used in the analysis of commercial real estate. It indicates how much of a property’s income is consumed by operating expenses. When building a multi-year proforma it can also be helpful to calculate the operating expense ratio for each year in the holding period to quickly spot and quantify trends in operating expenses relative to income.