The topic of replacement reserves is often confusing for commercial real estate professionals. How much should be set aside for replacement reserves? Should replacement reserves be included in net operating income? How do replacement reserves impact cap rates and value? In this article, we’re going to take a closer look at reserves for replacement, clear up the confusion, and also tackle some common misconceptions.

What are Replacement Reserves?

First, what are replacement reserves? Replacement Reserves are funds set aside that provide for the periodic replacement of building components that wear out more rapidly than the building itself and therefore must be replaced during the building’s economic life (short-lived items).

These components typically include the replacement of the roof, heating, ventilation, and air conditioning (HVAC) systems, parking lot resurfacing, etc. Note that replacement reserves do not include minor repairs and maintenance such as broken doorknobs or lightbulbs. These minor expenses are considered routine operating expenses, not irregular capital expenditures.

How much should be set aside for replacement reserves? As always, it depends. Typically, a commercial property will be inspected by a general contractor before acquisition. This will give you a good indication about what will need to be replaced over the intended holding period and allow you to work backwards into an appropriate replacement reserve amount. Additionally, many lenders will also require a replacement reserve to be set aside, usually in escrow, to cover major capital expenditures over the term of the loan.

Should Replacement Reserves be Included in NOI?

Conventional wisdom says no, replacement reserves should not be included in the NOI calculation. This is what’s taught in many commercial real estate textbooks and even the highly respected CCIM courses. However, just because something is popular doesn’t make it right. As always, the decision to include, or exclude, reserves for replacement from NOI largely depends on the context.

One thing to keep in mind is that many sellers and listing brokers will intentionally exclude replacement reserves from their proformas to boost NOI, and thus improve valuation. Buyers, on the other hand, are typically much more conservative when creating a proforma. Recognizing this tension can be helpful before entering into any negotiations. Additionally, lenders will almost always include a reserve for replacement figure in their NOI calculations when determining the maximum loan amount. This makes sense from their perspective because lenders want to minimize risk and ensure the property’s cash flow is sufficient to repay the loan. Maintaining an adequate reserve for replacement gives a lender more comfort that a property can support the loan without relying on any capital injections or guarantor support.

Where context becomes particularly important is in understanding how market-based cap rates are calculated. You want to ensure you’re comparing apples to apples. For example, it’s common for appraisers to value a property using a market-driven cap rate based on comparable properties in the relevant submarket. However, if the market-driven cap rate you are applying to a stabilized NOI is derived from properties with reserves already netted out, then this obviously wouldn’t make sense to apply this cap rate to an NOI without reserves included. Let’s take a quick example to illustrate the difference:

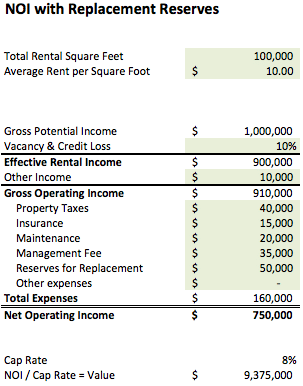

As shown in the above simple proforma, replacement reserves are included in the NOI calculation. As such, the calculated net operating income is $750,000 and the resulting valuation based on an 8% cap rate is $9,375,000. Now, let’s take a look at what happens when we exclude replacement reserves from NOI:

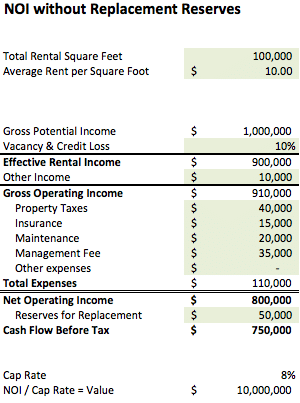

As you can see, the resulting valuation is $10,000,000, which is an improvement of $625,000. This is certainly a significant difference in value that should not be ignored. Keep this in mind when working with seller provided proformas. Also, when reviewing third-party appraisals, this is usually a good item to take a closer look at.

Ultimately, the practice of capitalizing NOI without including any ongoing expenditures required to maintain market-based rents isn’t wise. These ongoing capital expenditures may include reserves for replacement, and even tenant improvement and leasing commissions required to keep the property occupied. A sophisticated investor will, of course, understand this and most certainly take it into account when determining value. As Warren Buffett famously asked:

Does management think the tooth fairy pays for capital expenditures?Warren Buffett

Although Warren Buffett was referring to the misuse of Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA), the same concept certainly applies to NOI and commercial real estate. Why would you determine value without considering all required expenditures to keep the property occupied and otherwise competitive?

Conclusion

Replacement reserves are an important line item in any commercial real estate proforma. Capital expenditures are necessary for maintaining a competitive and fully occupied property. Yet, many people gloss over the reserves for replacement line item and often exclude it completely from the NOI calculation. As shown above this can have a significant impact on a property’s valuation and as such it should not be ignored. Whether you include replacement reserves in NOI or not is largely based on context, but in either case your choice should be based on sound reasoning.