Understanding the commercial real estate loan underwriting process can give you an advantage when seeking debt financing for a commercial property. In this article, we’ll discuss how lenders underwrite commercial real estate loans, and how to determine the maximum loan amount for a property.

Before a new loan goes through the full underwriting and credit approval process, the lender and the borrower will often have a preliminary discussion. The purpose of this discussion is to give the lender a better understanding of your project, and to also learn how the lender would underwrite a project like yours.

You should get a better understanding of current interest rates, and the bank’s current internal loan policy, which defines guidelines for different types of loans. For example, for an existing and stabilized office building, the lender will have specific requirements for the loan to value ratio, debt service coverage ratio, debt yield, amortization period, and loan term. For construction loans, the lender will have other requirements such as a loan to cost ratio or interest only periods. A home builder line of credit will likewise have additional requirements, such as advance limits and aging limits.

At this stage, the borrower might submit some supporting documentation for the property. For example, if your project was an office building, you might submit a rent roll and a proforma for the lender to evaluate. Typically, the lender will then discuss the deal internally with the senior lender or credit officer, and if the bank is comfortable with the deal, they’ll issue a term sheet and move forward with the full underwriting process.

Let’s take a look at what the bank’s internal evaluation might look like for an existing property at this preliminary stage.

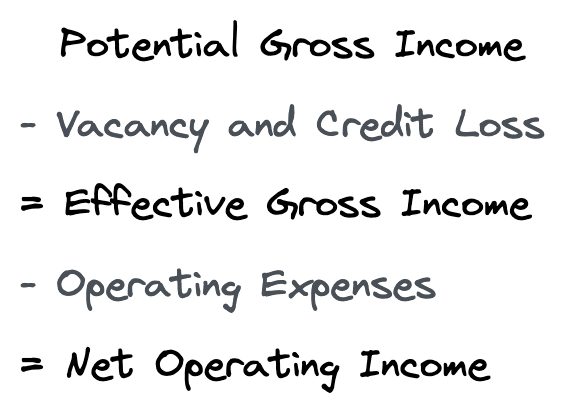

Net Operating Income (NOI)

The first step in commercial real estate loan underwriting is determining the appropriate Net Operating Income (NOI). The borrower will typically submit a rent roll and a proforma, but the lender will almost always construct their own proforma for loan underwriting purposes, which may result in a different NOI calculation. Possible lender adjustments to NOI include increasing the vacancy and credit loss factor to account for changing market conditions or tenant rollover risk, or deducting reserves for replacement from NOI.

After determining NOI, lenders have internal loan policy guidelines they use as underwriting criteria for different real estate projects. The two most important loan underwriting criteria used are the Loan to Value Ratio (LTV) and the Debt Service Coverage Ratio (DSCR).

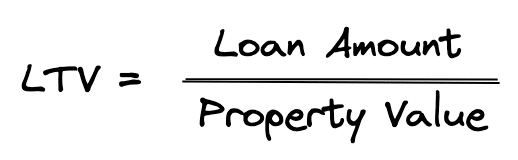

Loan to Value Ratio (LTV)

The loan to value ratio is simply the ratio of the total loan amount borrowed in relation to the value of the property.

For example, suppose the requested loan amount for a commercial real estate property was $1,000,000 and the appraisal came in with a value of $1,250,000. The LTV ratio would simply be $1,000,000/$1,250,000, or 80%.

Different banks usually have different but similar LTV requirements. This is driven by each bank’s internal strategic growth goals and existing portfolio concentrations. LTV guidelines also vary by property type to reflect variations in risk. For example, land is considered to be riskier than a stabilized apartment building, and as such the required LTV on land will be lower than on an apartment.

A critical issue with the loan to value ratio is how a lender determines value. Normally, a third-party appraisal firm is engaged during the full underwriting process to provide an appraisal report on the property. However, it’s worth noting that the lender doesn’t have to fully accept the appraised value and can still make downward adjustments to the appraised value.

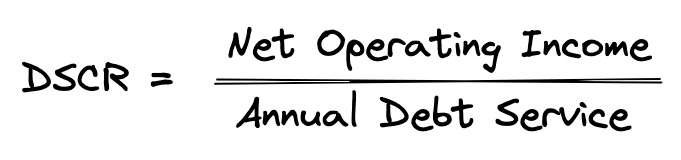

Debt Service Coverage (DSCR)

The debt service coverage ratio is the ratio of NOI to annual debt service. The reason this ratio is important to lenders is that it ensures the property has the necessary cash flow to cover the loan payments. The DSCR formula can be calculated as follows:

The DSCR gives the lender a margin of safety. For example, by requiring a 1.20x DSCR the lender is building in a cushion in the property’s cash flow over and above the annual debt service. At a 1.20x DSCR the property’s NOI could decline by 17% and the loan payments would still be covered.

Like the LTV ratio, the DSCR is set internally by the bank’s loan policy and can vary by property type. For instance, riskier properties like self-storage will typically have higher DSCR requirements than more stable properties like apartments.

Introducing CRE Loan Underwriting

The only online course that shows you how lenders underwrite and structure commercial real estate loans

Reviews key loan personnel at each stage of the loan approval process

Learn fundamental credit concepts used by all lenders

Understand the framework lenders use to underwrite any type of loan

5 detailed case studies using actual real world loans

Package of more than a dozen tools and templates you can download and use

60-day money back guarantee

Maximum Loan Analysis

The purpose of the maximum loan analysis is to determine the maximum supportable loan amount based on the NOI, the DSCR, and the LTV requirements. Once a lender calculates the net operating income, they will then calculate the loan amount using the loan to value and debt service coverage guidelines. Next, the lender will then take the lesser of the two loan amounts calculated based on the LTV approach and the DSCR approach, and this will be the maximum supportable loan amount.

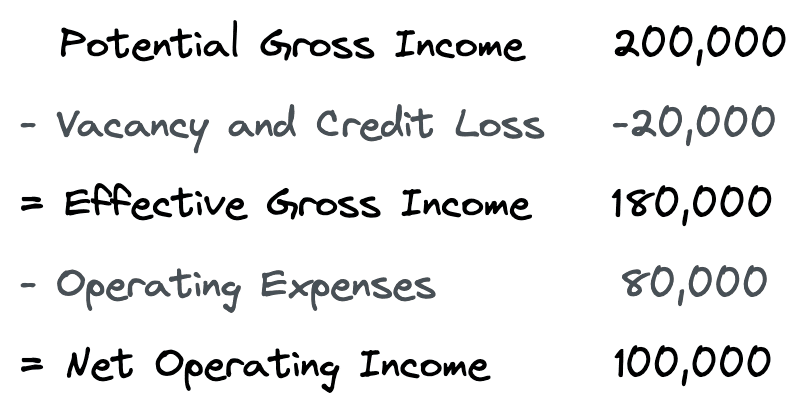

Let’s look at an example to clarify how this works. Suppose that you are acquiring a multi-tenant office property with the following stabilized NOI:

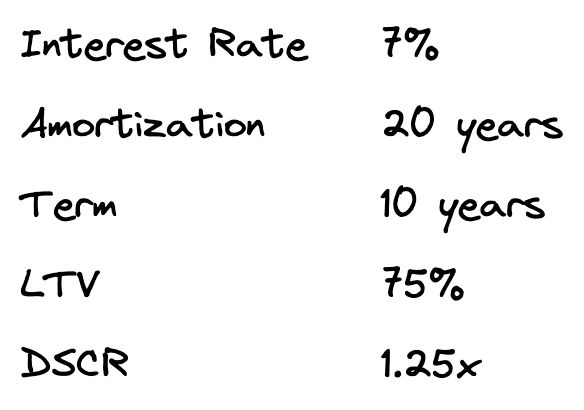

Further, suppose that after talking to your lender, you learn their current underwriting guidelines on this type of property are as follows:

Current interest rates are at 7%, and they would require a 1.25x DSCR using a 20-year amortization, with a maximum LTV ratio of 75%. Using all this information, let’s complete a maximum loan analysis to see how big of a loan you can get for your property.

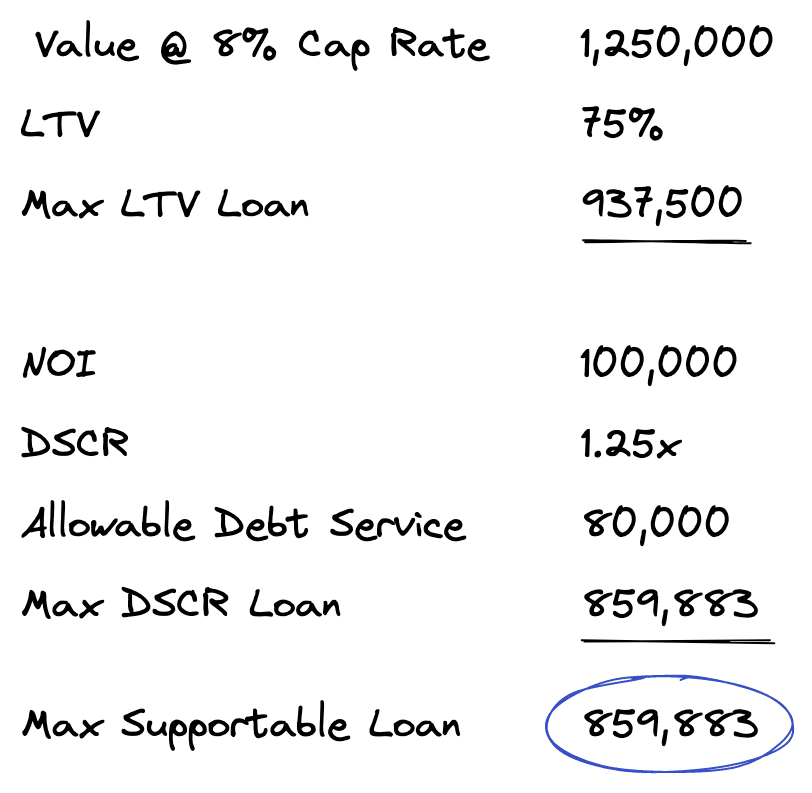

The analysis above shows how a bank would initially look at this loan request. First up is the maximum loan amount using the LTV approach. To find the maximum loan using this approach, the lender will estimate a value of the property at an appropriate cap rate. Initially, the cap rate used will be based on the lender’s knowledge of local market conditions, but ultimately the value must be supported by a third-party appraisal. In our example, the NOI of 100,000 is divided by 8% to get an approximate value of 1,250,000.

Next is the maximum loan amount based on the DSCR approach. To find the maximum loan using this approach, the lender will first take the NOI and divide it by the required DSCR. This will result in the portion of NOI that can be used to pay debt service each year. In our example, this is 100,000 / 1.25, or 80,000. In other words, if our NOI is 100,000 and our annual debt service is 80,000, then we would have 100,000 / 80,000 or 1.25x, which is the debt service coverage ratio needed to satisfy the bank’s requirements.

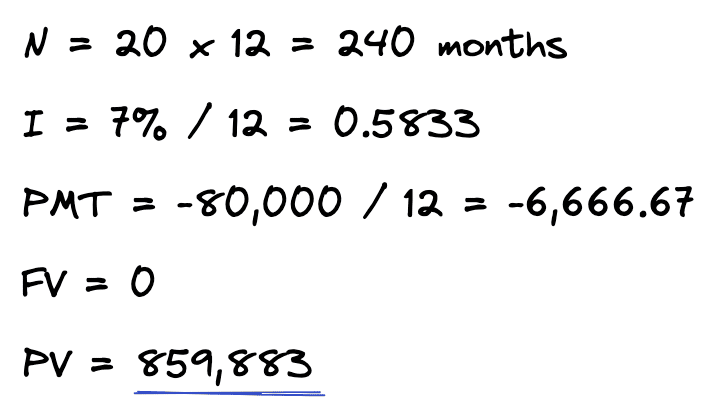

The lender can now use this allowable debt service of 80,000 to back into a loan amount. To accomplish this, we just need the interest rate and the amortization period to solve for the present value of the loan. Using a financial calculator, we can plug in these known variables and then solve for the present value, which is the loan amount.

Now the lender has two maximum loan amounts, one based on the LTV approach of 937,500, and another based on the DSCR approach of 859,883. The last step in calculating the maximum supportable loan amount for the property is to take the lesser of these two amounts. In our case, this results in a maximum loan amount of 859,883, which would likely be rounded down to 859,000.

Maximum Loan Analysis Cheat Sheet

Fill out the quick form below and we’ll email you our free maximum loan analysis Excel cheat sheet containing helpful calculations from this article.

Conclusion

In this article, we discussed how a bank underwrites a commercial real estate loan. We reviewed the net operating income, the loan to value ratio, and the debt service coverage ratio. We then demonstrated how a lender can use this information to complete a maximum loan analysis. Do you need help building a proforma and quickly running a maximum loan analysis, complete with presentation-quality PDF reports? You might consider giving our commercial real estate analysis software a try with a free trial.