Do you need a global cash flow analysis template for a bank loan or to get a handle on your own global cash flow? The PropertyMetrics team has created a free and helpful package for commercial real estate professionals who need to complete a global cash flow analysis:

About Our Global Cash Flow Analysis Template

In the world of credit analysis, understanding a borrower’s global cash flow is essential to determine their ability to repay their debts. This is where a global cash flow analysis template can be invaluable. It is a comprehensive tool designed to calculate a borrower’s cash flow from all sources, providing lenders with critical insights to make informed decisions.

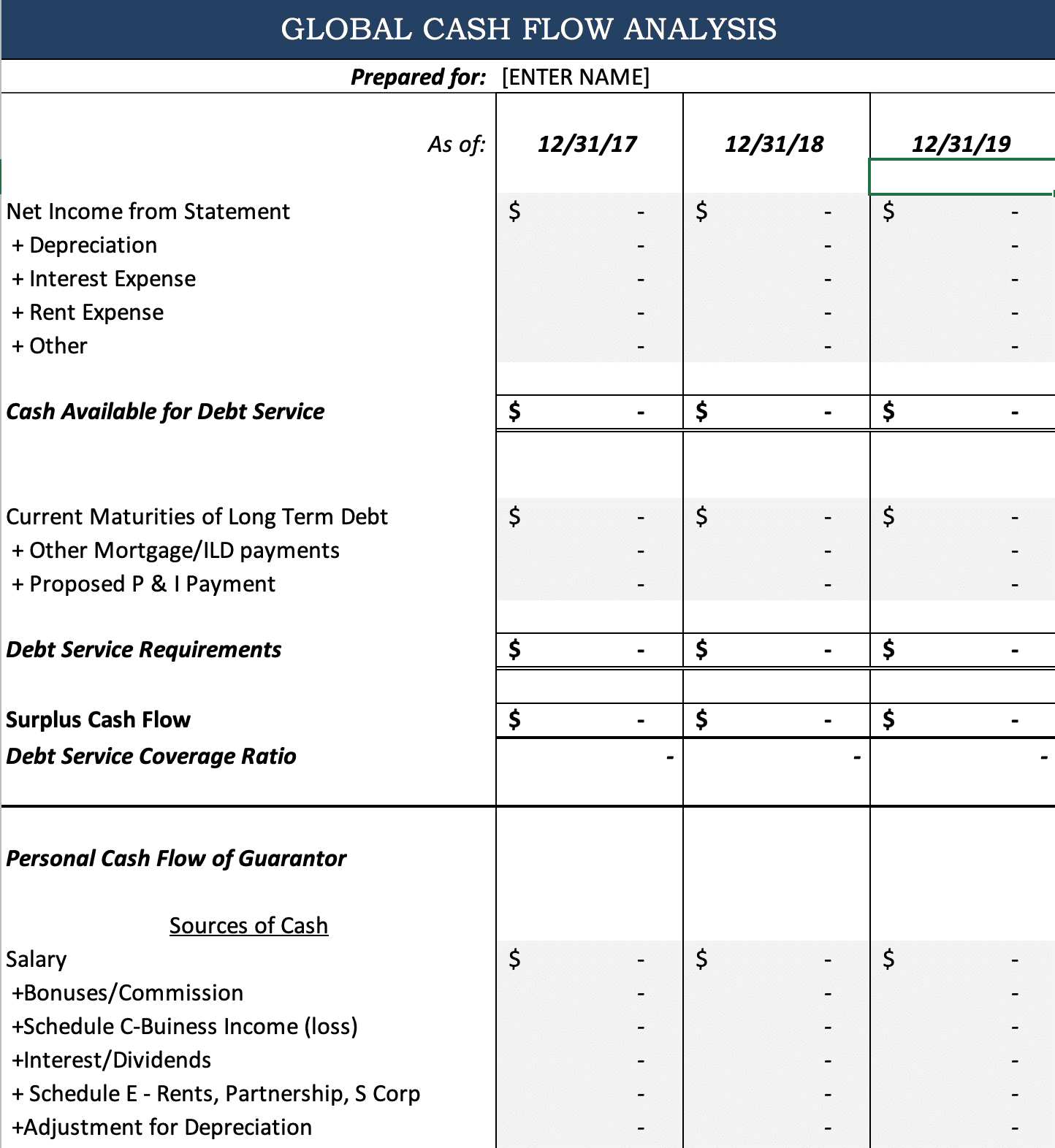

The global cash flow analysis template is an Excel spreadsheet form that includes various sections. Let’s take a closer look at each section and its importance.

- Net Income from Statement: This section calculates a borrower’s net income by deducting all expenses from their total income. It is an essential element to determine the borrower’s ability to generate cash.

- Depreciation: Depreciation is a non-cash expense that businesses can use to reduce their taxable income. This section adds back depreciation to the borrower’s net income to reflect their actual cash flow.

- Interest Expense: Interest expense is the amount a borrower owes on their debts, and this section calculates the interest paid on their debts. It is essential to determine the borrower’s ability to service their debts.

- Rent Expense: Rent expense is the amount paid by a borrower to rent a property or space. It is a critical expense for businesses that lease space and must be taken into consideration when calculating their cash flow.

- Other: The other section is a catch-all for other expenses that may not fall into any of the other categories. This section allows the borrower to include other necessary expenses that affect their cash flow.

- Cash Available for Debt Service: This section calculates the amount of cash that is available to service a borrower’s debts. It is an essential factor to determine whether the borrower has enough cash to meet their debt obligations.

- Current Maturities of Long-Term Debt: This section calculates the portion of the borrower’s long-term debts that are due in the next 12 months. It is important to track the upcoming payments to ensure the borrower has enough cash to meet their obligations.

- Other Mortgage payments: If the borrower has other mortgage payments, this section calculates the amount of cash needed to service those debts.

- Proposed P & I Payment: This section calculates the borrower’s proposed principal and interest payment. It is important to track this amount to ensure the borrower can afford to make these payments.

- Debt Service Requirements: This section calculates the total amount of cash needed to service all the borrower’s debts, including principal and interest payments. It is a critical factor to determine if the borrower has enough cash to meet their debt obligations.

- Surplus Cash Flow: Surplus cash flow is the cash that remains after all debts have been serviced. This section allows the borrower to see how much cash they have left to invest in their business or other ventures.

- Debt Service Coverage Ratio: The debt service coverage ratio is the ratio of cash available to service debt to the amount of debt owed. It is an essential factor to determine whether the borrower has enough cash to meet their debt obligations.

- Personal Cash Flow of Guarantor: If the borrower has a guarantor, this section calculates the guarantor’s personal cash flow. It is essential to determine if the guarantor has enough cash to support the borrower’s debts.

- Sources of Cash: This section calculates all the borrower’s sources of cash. This includes their salary, bonuses, commission, business income, interest, rents, partnership income, capital gains, and other income.

- Gross Personal Sources of Cash: This section calculates the total amount of personal cash flow available to the borrower.

- Income Taxes: Income taxes are a critical expense that must be taken into consideration when calculating the borrower’s cash flow.

- Net Personal Cash Flow Available for DS: This section calculates the borrower’s net personal cash flow available for Debt Service. It is essential to determine how much cash the borrower has available to service their debts.

- Uses of Cash: This section tracks all the borrower’s uses of cash, including their mortgage payments, consumer debt payments, and other expenses like alimony and child support.

- Total Personal Uses: This section calculates the total amount of cash the borrower uses personally.

- Surplus Personal Cash Flow: Surplus personal cash flow is the amount of cash that remains after all personal expenses have been paid. This section allows the borrower to see how much cash they have left for other investments.

- Personal Debt Service Coverage Ratio: This ratio is the borrower’s personal cash flow available for debt service divided by the total amount of debt owed. It is essential to determine if the borrower has enough personal cash flow to service their debts.

- Total Sources of Cash Available for DS: This section calculates the total amount of cash available to the borrower to service their debts.

- Total Uses: This section calculates the total amount of cash the borrower uses, including both personal and business expenses.

- Global Debt Service Ratio: This ratio is the total amount of cash available to service the borrower’s debts divided by the total amount of debt owed. It is an essential factor to determine if the borrower has enough cash flow to service all of their debts.

Overall, the global cash flow analysis template is an essential tool for lenders to determine a borrower’s ability to repay their debts. The template’s comprehensive sections allow for a detailed analysis of a borrower’s cash flow situation from all sources. It provides a more in-depth and accurate picture of the borrower’s financial position than just looking at their income statement or balance sheet.

It is important to note that the global cash flow analysis template is just one part of the credit analysis process. Lenders will also consider other factors such as the borrower’s credit history, collateral, and industry trends before making a final decision.

In conclusion, if you are a lender looking to assess a borrower’s cash flow situation accurately, the global cash flow analysis template is an invaluable tool. By considering all sources of cash flow, lenders can make informed decisions about whether to extend credit to a borrower.