Understanding the difference between the net present value (NPV) versus the internal rate of return (IRR) is critical for anyone making investment decisions using a discounted cash flow analysis. Yet, this is one of the most commonly misunderstood concepts in finance and real estate. This post will help you understand the difference between NPV vs IRR, and clear up some common misconceptions.

First, let’s go over some definitions of NPV and IRR, then we’ll walk through an example and some common pitfalls.

Net Present Value (NPV) Definition

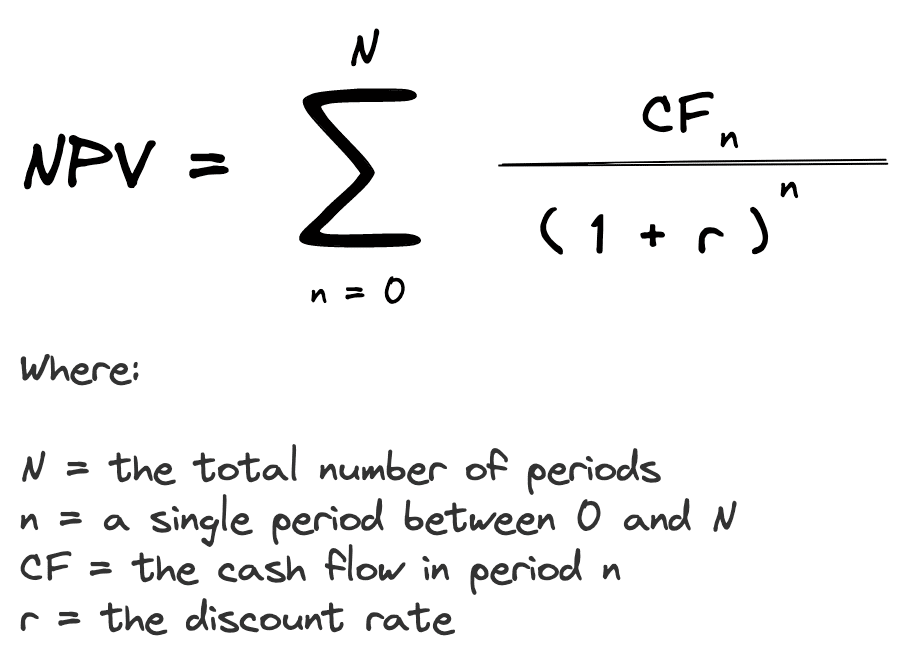

Net present value (NPV) is an investment measure that tells an investor whether the investment is achieving a target yield at a given initial investment. NPV also quantifies the adjustment to the initial investment needed to achieve the target yield, assuming everything else remains the same. Formally, the net present value is simply the summation of cash flows (CF) for each period (n) in the holding period (N), discounted at the investor’s required rate of return (r):

Internal Rate of Return (IRR) Definition

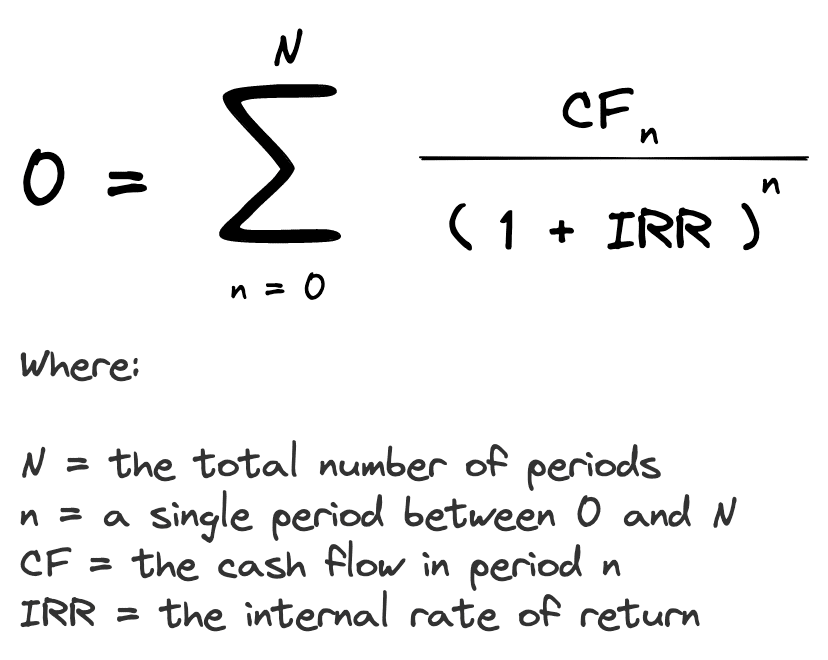

Internal rate of return (IRR) for an investment is the percentage rate earned on each dollar invested for each period it is invested. IRR is also another term people use for interest. Ultimately, IRR gives an investor the means to compare alternative investments based on their yield. Mathematically, the IRR can be found by setting the above NPV equation equal to zero (0) and solving for the rate of return (IRR).

Distinction Between NPV vs IRR

So, what’s the difference between NPV and IRR? As shown in the formulas above, the NPV formula solves for the present value of a stream of cash flows, given a discount rate. The IRR, on the other hand, solves for a rate of return when setting the NPV equal to zero (0).

In other words, the IRR answers the question: “What rate of return will I achieve, given the following stream of cash flows?”, while the NPV answers the question: “What is the following stream of cash flows worth at a particular discount rate, in today’s dollars?” To dive deeper into a more intuitive explanation of IRR and NPV, check out the Intuition Behind the NPV and IRR.

Quantitative Example of NPV vs IRR

Consider a property with expected future net cash flows of $30,000 per year for the next five years (starting one year from now). If you expect to sell the property 5 years from now for a price 10 times the net cash flow at that time, what is the value of the property if the required return is 12%?

Plugging in the $30,000 net cash flows for five years into the NPV equation above along with the 12% discount rate, you’ll find that the net present value is $278,371. You can also find all the formulas and answers to these questions in this spreadsheet we put together:

Download NPV vs IRR Excel Solutions

Where should we send your NPV vs IRR solutions file?

Now, let’s extend this example with a few more questions:

- Suppose the seller of the above building wants $300,000. Should you do the deal still assuming your required rate of return is 12%?

- What is the IRR if you pay $260,000, and how does this compare to the required return of 12%?

Plugging into the equations above (or using the above linked spreadsheet), if the owner insists on getting $300,000 for the building, it drives down the IRR to 10% and generates an NPV of -$21,629. This means you should not do the deal if your required return is 12%, and you would instead need to pay $21,629 less for the property to achieve your target yield.

Assuming you can negotiate the price down to $260,000, then your IRR becomes much more attractive at 13.87%. Also, at a $260,000 acquisition price, the NPV becomes a positive $18,371, which means that you could pay roughly $18,000 more for the property and still achieve your target yield of 12%.

Limitations of the Internal Rate of Return (IRR)

One problem with the IRR is that it ignores the initial investment amount. If you’re comparing two alternative investments and your only decision criteria is the IRR, then which is better – a 50% return on a $1,000 investment, or a 10% return on a $50,000 investment? If IRR was your only decision criteria, then you’d choose the first option, ignoring the size of your initial investment, and therefore the actual cash you’re able to receive as a result of your investment.

Another limitation of the IRR is that it doesn’t always equal the return on your initial investment over the holding period. When periodic cash flows exist in an investment that results in capital recovery, the IRR makes no assumptions about what you do with these interim cash flows. For example, you might put that cash flow into a bank account with a much lower yield than the IRR, which can be problematic when evaluating the true return for an investment.

Limitations of the Net Present Value (NPV)

One limitation of the NPV is that it doesn’t consider the timing or variability of cash flows. For example, which is better, a project that returns one lump sum in 10 years, or instead a project with even cash flows every year for ten years? These are two different investments and, depending on your needs, you might prefer one over the other, even if the NPV for both projects is the same.

Another limitation of the NPV is that it’s often difficult to accurately estimate the discount rate. Because of this, it might also be difficult to accurately account for the riskiness of projected cash flows. For example, if you’re evaluating a building with short-term leases, then you might consider bumping up your discount rate to account for this rollover risk. But exactly how much higher should your discount rate be? This is often a subjective decision that an objective measure, like the NPV, can’t easily account for.

No Silver Bullet for Investment Analysis

Understanding the difference between NPV vs IRR is important, but perhaps more important is understanding that there is no silver bullet for making an investment decision. Both NPV and IRR should be considered, along with other investment decision indicators such as the payback period and the capital accumulation method, as well as a solid understanding of your own investment needs, risk aversion, and available options.